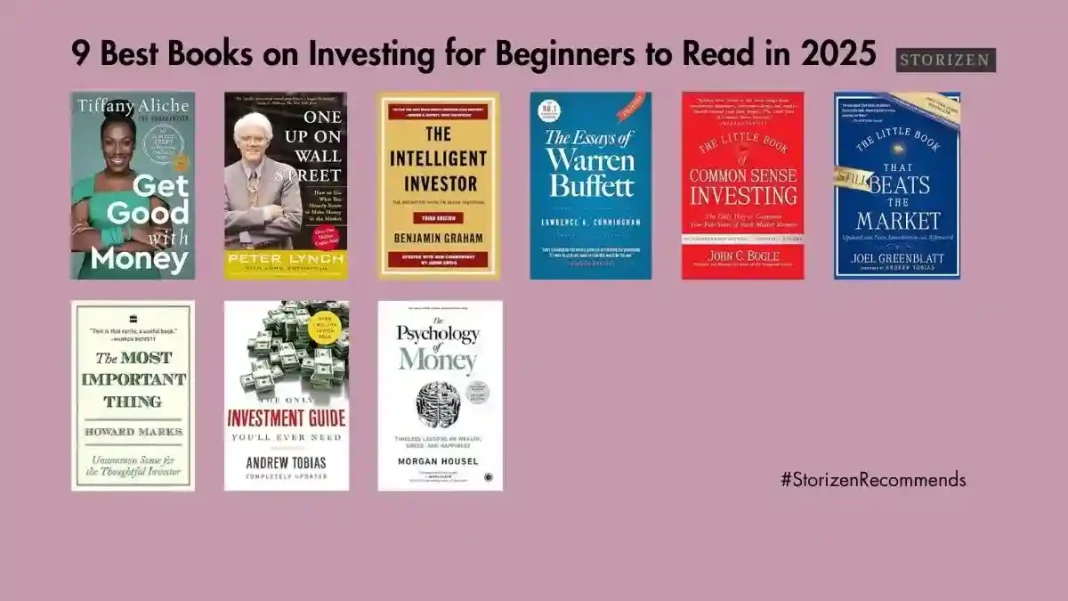

If you’re looking to begin your investment journey in 2025, choosing the right resources is crucial for building a solid foundation. Storizen has curated a list of the Best Books on Investing for Beginners to Read in 2025, featuring timeless guides from the world’s top investors and financial experts. Whether you’re interested in value investing, understanding market psychology, or finding strategies for long-term wealth creation, these books will provide you with the knowledge and confidence needed to navigate the world of investing. From John Bogle’s low-cost index fund strategies to Warren Buffett’s timeless wisdom, these reads will help you start investing with a clear, informed approach.

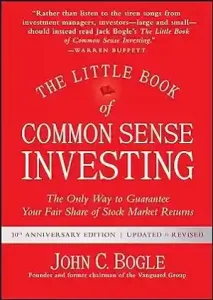

1. The Little Book of Common Sense Investing by John Bogle

The Little Book of Common Sense Investing by John C. Bogle is a timeless guide to building long-term wealth through low-cost index funds. Bogle simplifies investing with one key principle—own a broad market index fund, like the S&P 500, and hold it for the long haul, avoiding the pitfalls of stock-picking and market timing. This 10th-anniversary edition updates his proven strategy with fresh data and new insights on asset allocation and retirement investing. Endorsed by financial legends like Warren Buffett, Benjamin Graham, and Paul Samuelson, the book emphasizes the power of compounding returns while cautioning against excessive trading and high fees. With markets constantly fluctuating, Bogle’s wisdom remains a steady beacon, showing investors how to secure their financial future with a diversified, low-risk portfolio that captures the market’s full potential.

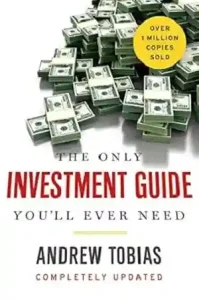

2. The Only Investment Guide You’ll Ever Need by Andrew Tobias

For nearly forty years, The Only Investment Guide You’ll Ever Need by Andrew Tobias has been a trusted and essential resource for anyone seeking practical, straightforward financial advice. With over a million readers who have relied on its wisdom, this book has earned its place as a go-to guide for smart money management. In this completely updated edition, Tobias brings his signature wit and clarity to the full spectrum of financial matters, from saving and investing to retirement planning, making it approachable for all—whether you’re just starting out or already managing substantial assets. With his no-nonsense approach, Tobias breaks down complex concepts in an easy-to-understand manner, giving you the tools to make informed decisions, avoid costly mistakes, and maximize your wealth. In today’s ever-evolving financial landscape, his insights remain as relevant and valuable as ever, helping readers navigate market fluctuations, optimize their financial strategies, and work toward long-term security. Whether you’re a beginner looking to build a solid foundation or a seasoned investor seeking to refine your approach, The Only Investment Guide You’ll Ever Need remains an indispensable roadmap to achieving lasting financial success.

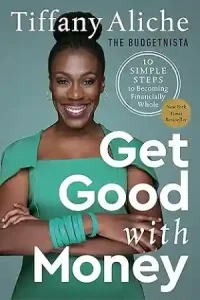

3. Get Good with Money by Tiffany the Budgetnista Aliche

Get Good with Money by Tiffany Aliche, the empowering “Budgetnista,” provides a practical and inspiring ten-step approach to achieving financial security through financial wholeness. With a focus on stability over get-rich-quick schemes, Aliche offers actionable advice on budgeting, saving, investing, improving credit, and planning for the future. Drawing from her own journey of overcoming financial hardship, she simplifies complex financial concepts with an accessible and encouraging style, making them relatable for readers of all income levels. Filled with helpful checklists, worksheets, expert insights, and real-world advice, this bestselling guide equips readers to build a strong financial foundation that provides both peace of mind and the freedom to pursue their dreams.

Also Read: 9 Best Nonfiction Books to Read in 2025

4. The Essays of Warren Buffett by Warren Buffett and Lawrence Cunningham

The Essays of Warren Buffett: Lessons for Corporate America is a modern classic that compiles the most valuable insights from one of the world’s most successful investors, Warren Buffett. Carefully curated, this collection offers a clear, engaging, and timeless guide to investing, business, and corporate leadership. Personally favored by Buffett himself, the essays span a wide range of topics, from financial wisdom to the philosophy behind Buffett’s investment decisions. The book is uniquely structured to avoid repetition, making it accessible to both new and seasoned readers, and it provides an informal yet deeply insightful education on how to approach investing and business management. With its enduring popularity over three decades, this book remains an essential read for anyone seeking to understand Buffett’s principles, giving readers the tools to apply these insights confidently in both business and investing. Whether you’re a novice investor or an experienced professional, this collection helps distill complex ideas into straightforward lessons that continue to influence the financial world today.

5. The Intelligent Investor by Benjamin Graham

The Intelligent Investor by Benjamin Graham is regarded as the ultimate guide to value investing, offering timeless wisdom that has stood the test of time since its first publication in 1949. Renowned for its deep, thoughtful approach to investment strategies, this 75th Anniversary Edition is a comprehensive resource that includes a fresh introduction and appendix by Warren Buffett—one of Graham’s most famous students—who highlights the lasting relevance of Graham’s principles in today’s market. Additionally, insightful chapter commentaries by Wall Street Journal writer Jason Zweig offer modern interpretations and applications of Graham’s original teachings, ensuring that readers understand how these principles apply in today’s financial world. Graham’s teachings provide a robust framework for avoiding costly mistakes, building smart investment strategies, and developing a long-term approach to managing wealth. By emphasizing the importance of discipline, patience, and risk management, The Intelligent Investor empowers readers to navigate market volatility with confidence. Whether you’re an experienced investor or just starting, this book remains an indispensable resource for anyone serious about building, protecting, and growing their wealth over time. With its blend of enduring principles and contemporary insights, it continues to be a cornerstone of sound investment knowledge.

6. The Little Book That Beats The Market by Joel Greenblatt

The Little Book That Still Beats the Market by Joel Greenblatt is a straightforward, witty, and highly effective guide to value investing, designed to make the principles of successful investing accessible to anyone, regardless of their experience. Building on the success of his 2005 bestseller, Greenblatt refines and simplifies his time-tested formula for identifying high-quality businesses available at bargain prices—a strategy that has consistently outperformed the market over time. This updated edition incorporates fresh insights from the 2008 financial crisis, strengthening the argument for why the method works and how investors can continue to apply it through market fluctuations. Greenblatt’s approachable style, which combines plain language, humor, and simple math, demystifies investing, proving that with the right approach, anyone can beat the market—not just seasoned professionals. His formula empowers readers to make informed investment decisions, emphasizing that consistent success in investing is within anyone’s reach, offering a roadmap for financial independence that’s both practical and achievable.

Also Read: 9 Best Dystopian Books to Read in 2025

7. One Up On Wall Street by Peter Lynch

One Up on Wall Street by Peter Lynch is an essential read for any investor seeking to gain an advantage over professional Wall Street traders. Written by one of America’s most successful mutual fund managers, the book unveils how everyday experiences and knowledge—from shopping at the supermarket to observing trends at your workplace—can help individual investors spot winning stocks long before Wall Street analysts catch on. Lynch emphasizes that successful investing isn’t about having insider information or complex data analysis; rather, it’s about using what you already know in your daily life to identify opportunities. Through practical insights and timeless strategies, the book guides readers on how to navigate market cycles, recognize undervalued stocks, and make smart, long-term investment decisions. Lynch shares real-world examples from his own career, showing how paying attention to the world around you can lead to exceptional investment choices. By empowering individuals to trust their instincts and knowledge, One Up on Wall Street provides a clear roadmap for building wealth and succeeding in the stock market without needing to rely on the expertise of professional investors.

8. The Psychology of Money by Morgan Housel

The Psychology of Money by Morgan Housel offers a deep dive into the emotional and psychological factors that shape our financial decisions, making the case that true success with money isn’t just about what you know—it’s about how you behave. Through 19 engaging and thought-provoking stories, Housel examines the powerful role that personal experiences, biases, and emotions play in influencing our approach to wealth, investing, and decision-making. Unlike typical finance books that focus primarily on numbers, formulas, and strategies, The Psychology of Money explores the human side of money, shedding light on the irrational and often counterproductive choices that people make when it comes to their finances. Housel delves into why people tend to overestimate their ability to predict the future, how the fear of losing outweighs the desire for gain, and how our upbringing and personal history impact our financial choices. Drawing on insights from behavioral economics and history, the book encourages readers to rethink their relationship with money, offering strategies for developing a healthier, long-term mindset. Whether you’re a seasoned investor or someone just beginning your financial journey, The Psychology of Money provides invaluable lessons on making smarter financial decisions, cultivating patience, and maintaining confidence during both prosperous and challenging times. By addressing the emotional undercurrents of financial behavior, this book helps readers approach money with greater clarity and a sense of balance.

9. The Most Important Thing by Howard Marks

The Most Important Thing by Howard Marks, chairman and co-founder of Oaktree Capital Management, distills a lifetime of investment wisdom into a single, comprehensive volume. Drawing from his extensive experience managing $100 billion, Marks shares his time-tested philosophy on what it takes to succeed as an investor. Aimed at both novices and seasoned professionals, the book outlines key principles for protecting capital, avoiding common pitfalls, and navigating the complexities of the financial markets. Marks uses insightful excerpts from his famous client memos to illustrate his ideas, offering practical examples and wisdom for developing a strong investment philosophy. In this brilliantly crafted work, Marks also delves into the psychology of investing, helping readers understand the nuances of market volatility and the critical importance of patience, discipline, and a long-term view in making investment decisions. Part memoir, part investment guide, The Most Important Thing provides invaluable lessons for investors seeking to thrive in the unpredictable world of finance.

In conclusion, the Best Books on Investing for Beginners to Read in 2025 offer invaluable insights that can help you make informed financial decisions and build a strong investment portfolio. Whether you’re just starting out or looking to refine your investment strategy, these books provide essential lessons from renowned financial experts, guiding you through the complexities of the market with clarity and confidence. By reading and applying the strategies outlined in these resources, you’ll be well-equipped to take control of your financial future and make smart, long-term investment choices that align with your goals. Happy investing!

Also Read: 9 Best Magical Realism Books to Read in 2025

Books are love!

Get a copy now!